An insurance repair warranty is a powerful tool that protects your investment by covering unexpected vehicle damage, including dent repairs, and ensuring minimal financial burden with services near your location. This cost-effective solution saves money in the long run by integrating comprehensive protection into vehicle ownership strategy, minimizing out-of-pocket expenses for body shop services like parts replacement, labor, and rental cars. Extending repair coverage enhances peace of mind and protects your car's aesthetics and resale value from minor to severe damages.

In today’s fast-paced world, unexpected repairs can disrupt your routine and put a strain on your budget. That’s where an insurance repair warranty steps in as a lifeline, offering extended repair coverage that goes beyond standard policies. This comprehensive guide explores the multifaceted advantages of this powerful tool. From peace of mind to significant cost savings and long-term investment protection, discover why securing an insurance repair warranty is a smart decision for any homeowner.

- Unlocking Peace of Mind: The Power of Insurance Repair Warranty

- Cost Savings Strategies: Benefits Beyond the Obvious

- Protecting Your Investment: Long-Term Advantages of Extended Coverage

Unlocking Peace of Mind: The Power of Insurance Repair Warranty

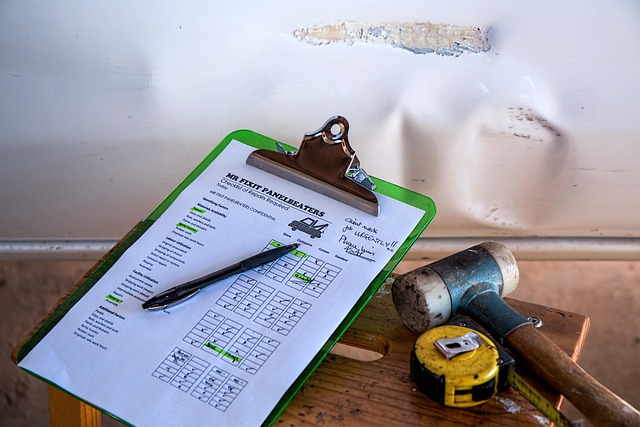

When it comes to protecting your investment, an insurance repair warranty is a powerful tool that offers unparalleled peace of mind. In the event of unexpected damage, whether from an accident or simply wear and tear, this warranty acts as a safety net, ensuring you’re not left with hefty repair bills. With an extended coverage plan, you gain access to comprehensive body shop services, including expert car dent repair, without the financial burden.

This warranty is especially beneficial when considering the convenience of having your vehicle restored to its pre-damaged condition close to your location. Many auto repair shops now offer these services, making it easier than ever to find a reliable auto repair near me that understands the value of an insurance repair warranty. By taking advantage of this coverage, you can focus on enjoying your ride without worrying about unexpected repairs.

Cost Savings Strategies: Benefits Beyond the Obvious

Many consumers often overlook the long-term financial benefits of extended repair coverage when purchasing a vehicle or insurance plans. However, this strategic move can prove invaluable in saving money over time, especially considering the unpredictable nature of vehicle repairs and maintenance. By enrolling in an insurance repair warranty, you gain access to cost-effective solutions for unforeseen vehicle repair incidents, which are often costly.

These warranties go beyond the basic coverage provided by traditional insurance policies, offering comprehensive protection against unexpected collision repair expenses. They typically include parts replacement, labor costs, and even rental car services during the repair period. By integrating such a warranty into your vehicle ownership strategy, you can minimize out-of-pocket expenses for body shop services, ensuring that any repairs are handled efficiently without straining your budget.

Protecting Your Investment: Long-Term Advantages of Extended Coverage

Extending your repair coverage is a proactive step that offers significant long-term advantages for any vehicle owner. When it comes to protecting your investment, an insurance repair warranty provides peace of mind and financial security. Regular wear and tear, accidental damages, or even severe weather events can all contribute to the deterioration of your car’s exterior, from minor dents and scratches to more extensive automotive body work and vehicle paint repairs.

By opting for extended coverage, you ensure that these issues are addressed promptly without breaking the bank. This warranty acts as a safety net, covering various services such as car dent removal and repainting, thereby maintaining the vehicle’s aesthetic appeal and resale value. In the long run, it’s a cost-effective solution that saves you from unexpected repairs and enhances the overall ownership experience.

Extending your repair coverage through an insurance repair warranty offers a comprehensive solution, providing peace of mind and significant cost savings. By safeguarding your investment, this coverage ensures that unexpected repairs don’t drain your wallet. The long-term benefits far outweigh the initial costs, making it a smart choice for anyone looking to protect their property and avoid financial strain in the event of damages. Embrace the advantages of an insurance repair warranty and rest assured knowing you’re prepared for any eventuality.