Insurance repair warranties protect policyholders from unexpected costs for vehicle repairs after incidents like collisions. By reviewing and understanding these warranties, drivers can maximize benefits, ensuring quality parts and labor within set timeframes without additional fees. Regular reviews ensure staying current with policy changes and smooth claims processes, offering peace of mind post-collisions.

Are you aware of the value hidden within your insurance repair warranty? These warranties, often overlooked, offer significant benefits for homeowners. In this article, we delve into the fundamentals of insurance repair warranties, explore their advantages, and guide you through claims navigation. Understanding your coverage can provide peace of mind, ensuring repairs are handled efficiently without unexpected costs. By reviewing these warranties, you empower yourself to make informed decisions regarding your home’s maintenance and protection.

- Understanding Insurance Repair Warranties: The Basics

- Benefits of Reviewing Your Warranty Coverage

- Navigating Claims and Ensuring Peace of Mind

Understanding Insurance Repair Warranties: The Basics

Insurance repair warranties are designed to protect policyholders from unexpected costs associated with vehicle repairs following a covered event like a car collision or auto glass damage. At its core, an insurance repair warranty guarantees that a designated auto shop will complete specific repairs using parts of a certain quality, often at no additional cost to the policyholder, for a set period after work is performed. This peace of mind is particularly valuable when dealing with costly repairs such as bumper repair or more complex issues that may arise from accidents.

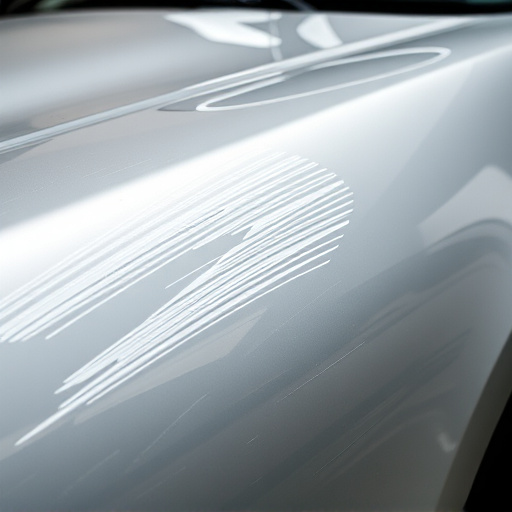

Understanding the terms and conditions of an insurance repair warranty is crucial. These warranties typically cover labor and parts within the specified timeframe, but exclusions and limitations exist. Policyholders should be aware of what’s included, such as coverage for frame straightening and paint repairs, and what’s excluded, like routine maintenance or damage not related to a covered incident (like wear and tear). By reviewing their insurance repair warranty, drivers can ensure they’re taking advantage of the benefits it offers, ultimately saving them time, money, and hassle in the event of a car collision or needing auto glass repair.

Benefits of Reviewing Your Warranty Coverage

Reviewing your insurance repair warranty is a proactive step that can significantly benefit you in unexpected situations. By understanding the scope of your coverage, you gain clarity on who is responsible for various types of repairs, especially non-cosmetic ones like auto glass repair or frame straightening. This knowledge empowers you to make informed decisions and avoid potential financial surprises when visiting an auto repair shop.

Regularly reviewing your warranty ensures you stay ahead of any changes in policies and terms. Insurance companies may update their repair coverage, and staying informed allows you to choose the best options for future claims. Moreover, understanding what’s covered can foster a healthier relationship with your insurer, as you’ll be better equipped to navigate claims processes and ensure you receive adequate compensation for eligible repairs.

Navigating Claims and Ensuring Peace of Mind

Navigating claims under an insurance repair warranty can seem daunting, but it’s a crucial aspect of ensuring peace of mind after a vehicle collision. With a comprehensive warranty in place, such as those offered for Mercedes-Benz models, owners have a safety net that covers various repairs and maintenance tasks. This means that if your car experiences a scratch repair or even undergoes a more extensive Mercedes-Benz collision repair, you’re protected against unexpected costs.

By reviewing the terms and conditions of your insurance repair warranty, you can understand what’s covered and for how long. This proactive step allows you to focus on getting your vehicle back on the road safely and efficiently without worrying about financial burdens. With a clear understanding of the warranty, drivers can rest assured that their investment is protected, providing them with a sense of security during an otherwise stressful situation like a vehicle collision repair.

An insurance repair warranty is a valuable tool that offers peace of mind, ensuring your property repairs are covered. By reviewing your policy’s details, you can maximize its benefits, navigate claims efficiently, and protect yourself from unexpected costs. Regularly assessing your coverage ensures you’re prepared for any repairs, giving you the freedom to focus on rebuilding rather than financial worries.