An insurance repair warranty guarantees quality repairs like glass replacement and bodywork, shifting financial risk from customers to insurers. It offers peace of mind, enhances vehicle value, and includes perks like dent removal. When choosing, compare plans based on labor rates, materials, and additional services, prioritizing those covering major and minor auto body repairs from reputable providers with positive reviews and understood exclusions.

Understanding the value of an insurance repair warranty can be transformative for homeowners. These warranties offer peace of mind, ensuring that repairs after unforeseen events—from water damage to storms—are covered, reducing financial burden and stress. This article delves into the intricacies of these warranties, highlighting their key benefits and guiding you in selecting the ideal plan to safeguard your home and budget.

- What Is an Insured Repair Warranty?

- Key Benefits of Having This Coverage

- How to Choose the Right Repair Warranty Plan

What Is an Insured Repair Warranty?

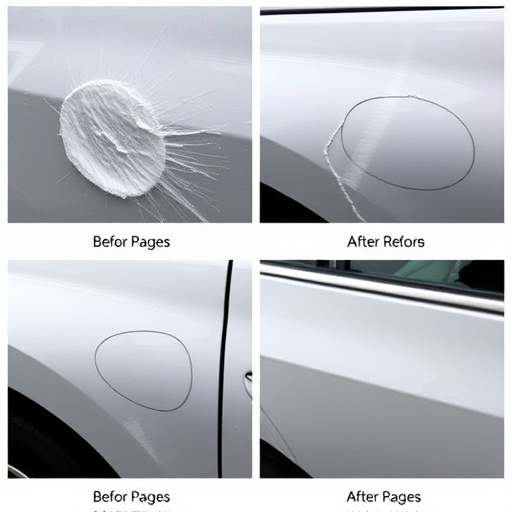

An Insured Repair Warranty is a type of protection offered by insurance companies or automotive service providers that guarantees the quality and longevity of specific repair services. This warranty acts as an added assurance for customers who opt for repairs like auto glass replacement, car dent repair, or bodywork fixes. When you choose a vehicle service with an insured repair warranty, it means that if any issues arise within a specified period after the repair, the insurance company will cover the cost of additional fixations or replacements.

This type of warranty is designed to build trust between customers and repair shops by demonstrating the shop’s commitment to delivering high-quality work. It also shifts some financial risk from the customer to the insurer, providing peace of mind knowing that potential future costs related to repairs are covered. Whether it’s fixing a cracked windshield or repairing minor dents, an insured repair warranty offers a safety net, ensuring customers receive reliable and long-lasting results for their automotive needs.

Key Benefits of Having This Coverage

Having an insurance repair warranty offers numerous advantages for vehicle owners. One of the primary benefits is peace of mind. Knowing that your car is covered in case of unforeseen repairs, such as those resulting from accidents or weather damage, can significantly reduce stress and financial burden. This warranty ensures that you won’t be left with unexpected costs when visiting a collision repair center for necessary fixes.

Moreover, an insurance repair warranty enhances the overall value of your vehicle. Repairs made under this coverage are typically performed by reputable car repair shops using high-quality parts, ensuring your vehicle remains in excellent condition. This can translate into better resale value or trade-in options down the line, making it a worthwhile investment for any car owner. Additionally, many policies include perks like complimentary car dent removal and other cosmetic repairs, further adding to the convenience and benefits of this type of coverage.

How to Choose the Right Repair Warranty Plan

When selecting an insurance repair warranty, consider your vehicle’s specific needs and your financial comfort level. Assess the scope of coverage offered by different plans, focusing on aspects like labor rates, material types, and additional services such as car body restoration or paint jobs. Ensure the warranty covers both major and minor auto body repairs to give you peace of mind.

Research reputable providers known for quality service in auto body repairs. Read customer reviews and understand what’s excluded from coverage. Remember, a good insurance repair warranty should complement your car repair services, offering protection against unexpected costs while promoting trusted partnerships with reliable mechanics.

An insurance repair warranty is a powerful tool that offers homeowners peace of mind and significant financial protection. By understanding the benefits outlined in this article, such as coverage for unforeseen repairs, access to reputable contractors, and cost savings, it’s clear that investing in this type of warranty can be a smart decision. When choosing a plan, consider your home’s needs, budget, and preferred level of coverage. With the right insurance repair warranty, you can ensure your home remains in top condition without breaking the bank.