The Insurance Repair Warranty (ERC) offers comprehensive vehicle protection beyond standard manufacturer's warranties, covering mechanical failures, accidental damage, and wear and tear. It guarantees essential services like tire services, car paint repairs, and autobody restorations, providing peace of mind and extending the lifetime of vehicles by eliminating unexpected repair costs. Investing in this warranty acts as a shield against financial vulnerability for vehicle owners.

“Uncover the power of extended repair coverage and its transformative impact on your peace of mind. This comprehensive guide delves into the intricacies of this powerful tool, focusing on the insurance repair warranty.

We explore its definition, unraveling the benefits it offers as an essential safety net for your investments. By understanding why this type of warranty matters, you’ll gain insight into securing your assets and ensuring long-term protection.”

- What is Extended Repair Coverage?

- Benefits of Insurance Repair Warranty

- Protecting Your Investment: Why It Matters

What is Extended Repair Coverage?

Extended Repair Coverage (ERC) is an insurance product designed to go beyond the standard manufacturer’s warranty period, offering protection for various vehicle components and services. It provides peace of mind by ensuring that car owners can access repairs and maintenance without incurring significant out-of-pocket expenses. ERC covers a wide range of issues, including mechanical failures, accidental damage, and even wear and tear over time. This comprehensive insurance repair warranty extends the lifetime of vehicles, making it an attractive option for those seeking long-term protection.

The benefits are numerous, especially when considering essential services like tire services, car paint repairs, and autobody restorations. ERC guarantees that these crucial components are covered, ensuring vehicle safety and performance. By offering extended coverage, car owners can focus on enjoying their rides without worrying about unexpected repair costs, thereby enhancing the overall ownership experience.

Benefits of Insurance Repair Warranty

An insurance repair warranty is a powerful tool that offers several advantages to policyholders when it comes to managing and repairing their vehicles after an accident or damage. This type of warranty goes beyond traditional collision repair services, providing added peace of mind for car owners. By ensuring that repairs are covered, even for issues not immediately apparent, policyholders can rest assured that they won’t be left with unexpected costs.

This warranty extends the protection offered by auto glass replacement and dent removal services, encompassing a broader range of potential repairs. It means that if your vehicle requires any covered repairs during the specified period, you won’t have to pay out of pocket. This benefit is especially valuable for those who want to maintain their vehicle’s condition without incurring heavy expenses, ensuring that their investment remains protected.

Protecting Your Investment: Why It Matters

Investing in extended repair coverage is akin to safeguarding your valuable asset—be it a sleek sports car or a reliable family sedan. In an era where unexpected repairs can significantly strain budgets, an insurance repair warranty offers peace of mind. It acts as a protective shield, ensuring that unforeseen issues with your vehicle don’t leave you financially vulnerable.

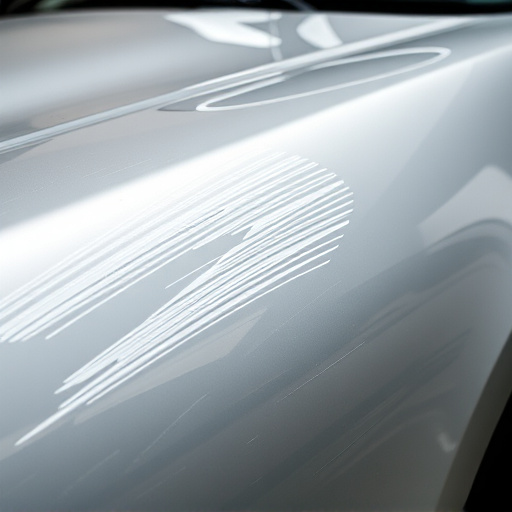

This coverage is particularly pertinent when considering the costs associated with auto painting, scratch repair, or even comprehensive car restoration. By opting for extended repair coverage, you’re taking proactive steps to mitigate potential expenses. This way, if your car encounters a fender bender or accumulates subtle yet noticeable scratches over time, these repairs can be handled without causing a dent in your savings.

Extending your repair coverage through an insurance repair warranty offers significant advantages, ensuring peace of mind and protecting your investment. By understanding the benefits outlined in this article, you can make an informed decision to safeguard your property and avoid costly repairs in the future. An insurance repair warranty is a valuable tool that every homeowner should consider, providing added protection and convenience.