A Third-Party Warranty Plan provides flexible and comprehensive coverage for consumer goods, especially cars, extending beyond manufacturer warranties. Offering broader terms, benefits like roadside assistance, and rental car services, these plans ensure vehicle owners access reliable repairs without high out-of-pocket expenses. They cover a wide range of damages, including mechanical failures, accidents, and minor incidents, allowing policyholders to choose any qualified mechanic for cost-effective repairs.

In today’s digital age, where gadgets are an integral part of our lives, ensuring their longevity and protecting against unexpected repairs is crucial. Third-party warranty plans offer a comprehensive solution by insuring your device repairs, providing peace of mind, and potential cost savings. This article explores the benefits of such plans, highlighting how they can safeguard your budget from hefty repair bills. We’ll break down the advantages, focusing on insurance, coverage, and long-term financial security for your devices.

- What is a Third-Party Warranty Plan?

- Benefits of Insuring Your Repairs

- How These Plans Can Save You Money

What is a Third-Party Warranty Plan?

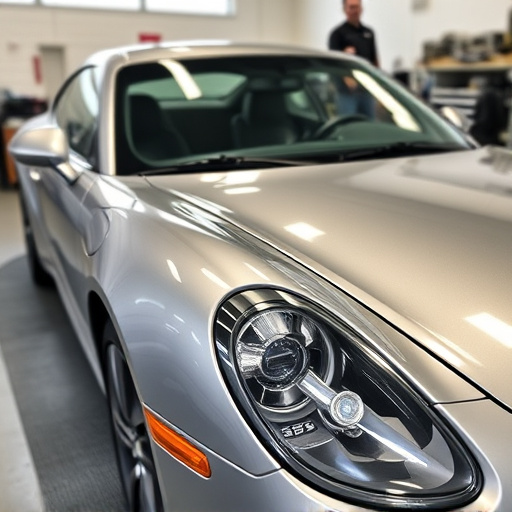

A Third-Party Warranty Plan is an insurance product designed to cover the cost of repair or replacement for products that are no longer under the manufacturer’s warranty period. These plans are typically offered by independent providers and can be applied to various consumer goods, with a particular focus on cars and vehicles. In the context of car ownership, it provides peace of mind, knowing that unexpected repairs due to mechanical failures or accidents won’t put a significant financial strain on the owner.

Unlike manufacturer-backed warranties, which often come at a premium cost and have specific terms and conditions, third-party warranties offer more flexibility and broader coverage. They can include services like roadside assistance, rental car benefits during repairs, and even coverage for wear and tear in some cases. For vehicle owners, this means access to reliable auto body repair shops and specialists without the worry of excessive out-of-pocket expenses, ensuring that their vehicles remain in top condition.

Benefits of Insuring Your Repairs

Insuring your repairs through a third-party warranty plan offers numerous advantages for vehicle owners. One of the key benefits is peace of mind; knowing that unexpected mechanical issues or accidental damage won’t leave you with a hefty repair bill can significantly reduce stress. These plans typically cover a wide range of services, including collision damage repair and even paintless dent repair, ensuring that your vehicle’s aesthetic and structural integrity are maintained.

Additionally, they provide financial protection against the cost of repairs in an automotive body shop. This is especially valuable for those who may not have the financial flexibility to cover major maintenance or repair expenses out of pocket. By having a warranty, owners can access quality services without worrying about the financial burden, allowing them to focus on enjoying their vehicle rather than being concerned with potential breakdowns or accidents.

How These Plans Can Save You Money

Third-party warranty plans offer significant financial benefits for vehicle owners. Unlike traditional manufacturer’s warranties that primarily cover major mechanical failures, these insurance repair warranties provide comprehensive protection against various types of damage. This includes not just engine or transmission issues but also accidents like fender benders, hail damage, and even minor incidents such as car scratch repairs. By opting for a third-party plan, you can avoid hefty out-of-pocket expenses associated with unexpected repairs at an auto collision center.

One of the key advantages is the flexibility they offer in choosing repair facilities. Unlike manufacturer-restricted options, policyholders are free to visit any qualified mechanic or specialized auto body shop for services like paintless dent repair. This freedom allows you to compare prices and select the best option for your budget, ensuring cost savings on repairs that might otherwise strain your finances.

Third-party warranty plans offer significant advantages for consumers, providing an extra layer of protection and peace of mind. By insuring your repairs, these plans ensure that unexpected costs don’t strain your budget. In a world where product defects can lead to costly fixes, a third-party insurance repair warranty is a smart investment, ultimately saving you money in the long run.