Crafting a robust insurance repair warranty requires clear definitions of duration, scope, deductibles, and exclusions for comprehensive coverage and customer satisfaction. This includes detailing covered damages in processes like Mercedes Benz collision repair or auto painting, empowering insurers and repair facilities to handle disputes effectively. A comprehensive warranty covering labor, materials, and mechanical repairs for set durations builds trust, streamlines claims, and enhances auto repair businesses' reputations.

An insurance repair warranty is a crucial safety net, offering peace of mind and financial protection after unforeseen events. This article delves into the key elements that constitute a solid warranty, guiding policyholders in understanding their coverage. From defining essential components like scope of repairs and eligible parts to navigating terms, conditions, and exclusions, we explore what makes a warranty effective. Learn how to ensure comprehensive protection for your property and assets through strategic warranty selection and careful review.

- Defining Key Components of Insurance Repair Warranty

- Ensuring Coverage for All Repairs and Parts

- Clear Terms, Conditions, and Exclusions for Transparency

Defining Key Components of Insurance Repair Warranty

When crafting an insurance repair warranty, it’s crucial to define key components that ensure comprehensive coverage and customer satisfaction. An effective insurance repair warranty should encompass several essential elements, each playing a vital role in protecting both the insured and the reparer. These include detailed specifications for coverage duration, the scope of repairs, deductibles, and exclusions, ensuring transparency and clarity from the outset.

For instance, in the context of mercedes benz collision repair or auto painting, warranties should specify what types of damages are covered, whether it’s limited to specific parts or includes labor costs as well. This transparency is key to fostering trust and ensuring that customers understand their rights and responsibilities under the warranty agreement. By clearly defining these components, insurers and repair facilities can navigate complex scenarios, providing a solid foundation for resolving disputes and delivering high-quality service.

Ensuring Coverage for All Repairs and Parts

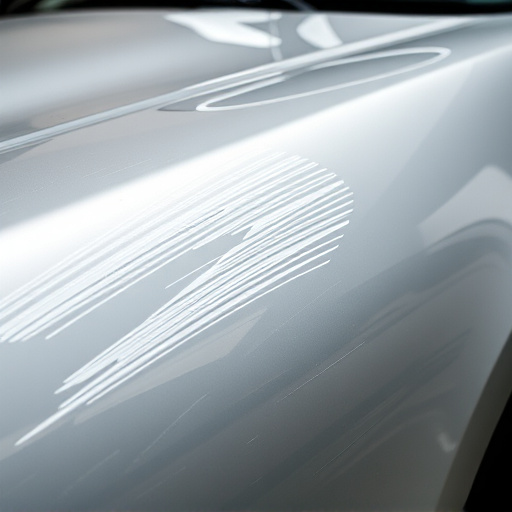

A robust insurance repair warranty should encompass comprehensive coverage for all repairs and parts involved in the restoration process. This means ensuring that not only labor costs are included, but also the materials used to fix or replace damaged components. When you’re considering auto body services from a vehicle body shop near me, it’s crucial to understand what specific parts are covered under warranty. For instance, does it include the cost of new panels, paints, and even mechanical repairs? A thorough review will help ensure that any unforeseen expenses don’t arise later on, providing peace of mind for customers.

Furthermore, a solid insurance repair warranty should clearly outline the duration of coverage. This period could vary depending on the extent of the initial repair work and the specific policies of the auto body shop. Customers should be aware of their rights and responsibilities during this time, such as prompt notification in case of any issues or needing to return for follow-up repairs. Ensuring transparency around these matters fosters trust between customers and service providers, promoting a positive reputation for auto repair near me businesses that prioritize customer satisfaction.

Clear Terms, Conditions, and Exclusions for Transparency

A solid insurance repair warranty should be crystal clear, leaving no room for ambiguity. It’s essential to outline specific terms, conditions, and exclusions upfront to ensure transparency between the insured and the repair facility. This clarity empowers policyholders to understand their coverage limits and what’s expected of them during the repair process. For instance, it might specify that while a car dent repair or fender repair is covered under certain circumstances, frame straightening often falls outside of standard warranties due to its complexity.

Such transparency encourages trust between all parties involved. Policyholders can feel confident knowing exactly what’s included in their coverage, and repair facilities can avoid misunderstandings by adhering to the defined terms. This clarity also facilitates a smoother claims process, as both sides are on the same page regarding expectations and responsibilities, especially when it comes to frame straightening or other specialized repairs.

An insurance repair warranty is a cornerstone in fostering trust between policyholders and insurers. By defining key components like coverage scope, transparent terms, and conditions, as well as ensuring all repairs and parts are included, individuals can confidently protect their investments. These essential elements create a robust framework that guarantees peace of mind, ensuring every repair is handled with reliability and integrity.