Insurance repair warranties protect policyholders and insured vehicle owners by ensuring repairs meet quality standards. Insurers collaborate with trusted repair facilities, set clear standards, and manage communication to safeguard interests and maintain system integrity. Repairs use high-quality materials and adhere to guidelines, while contractors coordinate claims and guarantee compliance with insurance terms, fostering trust and satisfaction in vehicle restoration after incidents like car collisions.

In the complex landscape of insurance claims, understanding who is accountable for ensuring compliance with repair warranties is paramount. This article delves into the intricate dynamics behind insurance repair warranties, elucidating key roles and responsibilities. We explore how insurers play a crucial part in upholding warranty obligations, while highlighting the duties of repairs and contractors. By examining these aspects, we aim to provide clarity on navigating and enforcing insurance repair warranties effectively.

- Understanding Insurance Repair Warranties

- Role of Insurers in Warranty Compliance

- Responsibilities of Repairs and Contractors

Understanding Insurance Repair Warranties

Insurance repair warranties are designed to protect both policyholders and insured vehicle owners by ensuring that repairs made under specific insurance policies meet certain quality standards. These warranties act as a safety net, guaranteeing the work performed by certified car body shops or vehicle body shops, especially when it comes to car paint services. Understanding what’s covered and the terms of the warranty is crucial for any policyholder looking to avail themselves of these benefits.

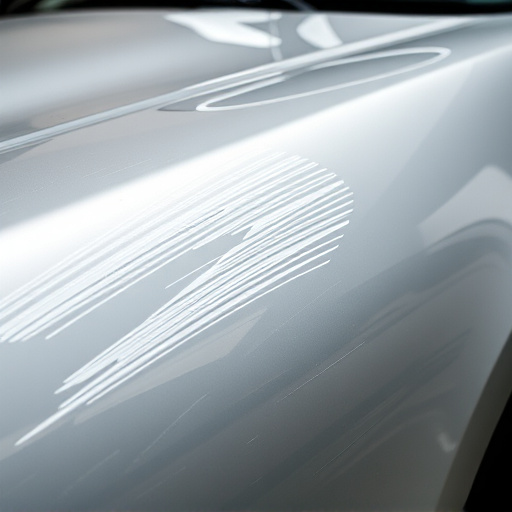

When an insured individual files a claim for repairs, whether it’s for a fender bender incident or more extensive damage, the insurance company typically involves authorized repair facilities. These car body shops are trained to follow specific guidelines and use approved materials as per the insurance company’s standards. The warranty then comes into play, assuring policyholders that their vehicles will be restored to pre-accident condition without any hidden costs or substandard workmanship. This is particularly relevant for vehicle body shops specializing in precise and reliable car paint services.

Role of Insurers in Warranty Compliance

Insurers play a pivotal role in ensuring compliance with insurance repair warranties. When a policyholder files a claim for vehicle paint repair or car restoration following an accident, such as a car collision repair, the insurer is responsible for overseeing the entire process to guarantee that the work meets the stated warranty standards. They do this by engaging with reputable repair facilities and setting clear guidelines for the repair work, ensuring both quality and cost-effectiveness.

Insurers also facilitate communication between policyholders, repair shops, and warranty providers, acting as a liaison to resolve any disputes or discrepancies that may arise during the insurance repair warranty process. By upholding these standards, insurers protect their policyholders’ interests while maintaining the integrity of the insurance system, ultimately fostering trust and satisfaction in the event of unexpected repairs or restoration work.

Responsibilities of Repairs and Contractors

When it comes to insurance repair warranties, both repairs and contractors play pivotal roles. Repairs, whether they’re handling autobody repairs or car paint services, are responsible for ensuring that their work meets the standards set by the warranty. This includes using high-quality materials and adhering strictly to manufacturer guidelines during vehicle bodywork processes. Contractors, on the other hand, act as intermediaries between insurance companies and repair facilities. They coordinate claims, oversee the entire process, and guarantee that all repairs are conducted according to the terms of the insurance repair warranty.

The responsibilities are crucial for maintaining customer satisfaction and preserving the integrity of the warranty. Contractors must effectively communicate with both insurers and repair shops, ensuring that everyone is aligned on expectations, timelines, and quality standards. This collaborative approach facilitates seamless autobody repairs and vehicle bodywork services while upholding the financial protection promised by insurance repair warranties.

In ensuring smooth post-disaster recovery, compliance with insurance repair warranties is pivotal. While insurers play a key role in guaranteeing repairs meet specified standards, repairs and contractors bear the responsibility of adhering to these warranties. By understanding their respective duties, stakeholders can navigate the process effectively, fostering timely restoration and upholding the integrity of reconstruction efforts. Ultimately, this collaborative approach contributes to resilient communities post-disaster events, underpinned by reliable insurance repair warranties.